Climate Megatrends + Q1’24 Report + National Security!

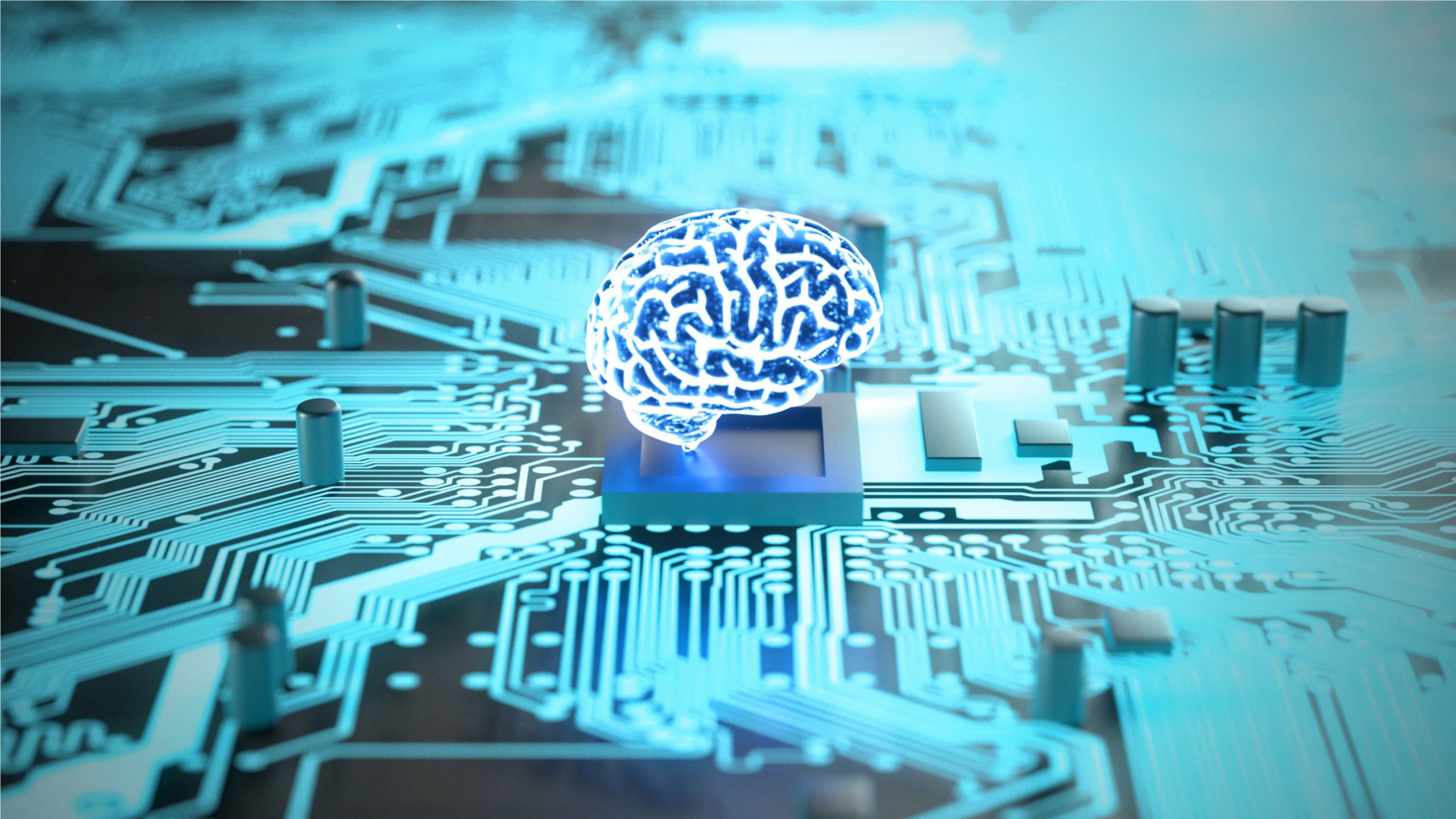

This is Jessie with Global League (G-L.Ventures) – a network for collaboration between investors to help the most impactful startups recommended by investors. We prioritize climate tech with high impact, AI infra, automation, and semiconductors. We share information for your reference, invite collaboration, and do not solicit or endorse any investments. We always ensure to…