This is Jessie with Global League (G-L.Ventures) – a network for collaboration between investors to help the most impactful startups recommended by investors.

- We prioritize climate tech with high impact, AI infra, automation, and semiconductors.

- We share information for your reference, invite collaboration, and do not solicit or endorse any investments.

- We always ensure to have industry experts in evaluation and use a digital platform to support the process of avoiding cognitive bias. (sign up below)

- We help with venture building and make introductions whenever possible.

Climate Megatrends

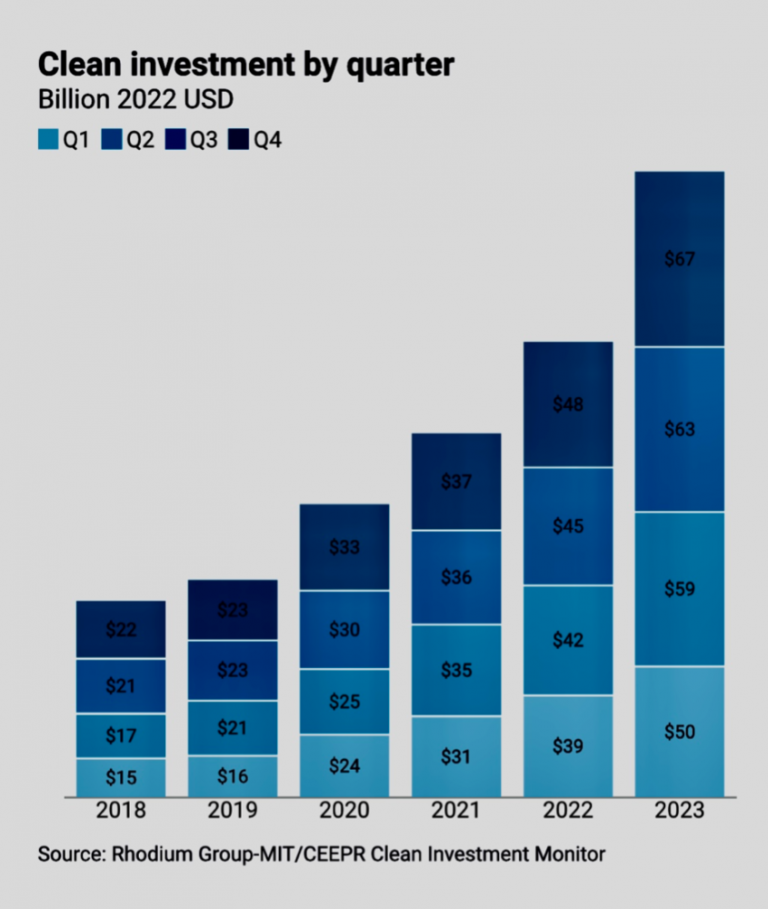

A quiet green economic boom, as Capital for Climate called it, an American economy transformation is gaining steam 2.5 years after the passage of President Joe Biden’s Inflation Reduction Act (IRA). Estimates of a total IRA impact range from a low of $384 billion to a recent estimate by Goldman Sachs of more than $1 trillion.

In 2023, NATO unveiled DIANA (Defense Innovation Accelerator for the North Atlantic) and a €1 billion fund to invest in tech, with money pooled from member countries, is the first venture capital initiative for Europe’s militaries. NATO invited startups working on cybersecurity, surveillance, and energy resilience. The last category was defined as tech that helps Allied nations recover from “energy disruptions,” a nod to the fear that’s swept Europe since Russia’s war that power supplies might be choked off. The program accepted 13 startups, primarily in the clean energy sector, that make power grids resilient or support microgrids. They’re working to reinvent a range of components, from electric grid transformers in London to wind turbines in Reykjavik and storage batteries in Delft. (Source)

The German government announced a €23 Billion “climate protection contracts” for companies in sectors like steel, cement and glass to cover additional expenses incurred in using cleaner technologies, compared with conventional processes. (Source)

Brazil and France on Tuesday launched an investment program to protect the Brazilian and Guyanese Amazon rainforest involving 1 billion euros ($1.1 billion) in private and public funds over the next four years. (Source)

Australian internet giant NBN raises 1.3 billion euros in green bonds. The proceeds will be issued to eligible green projects such as energy efficiency and green power. (Source)

State of Climate Tech Q1 2024

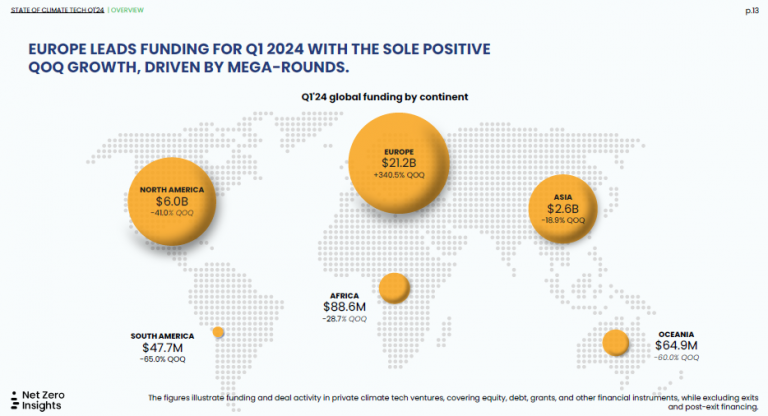

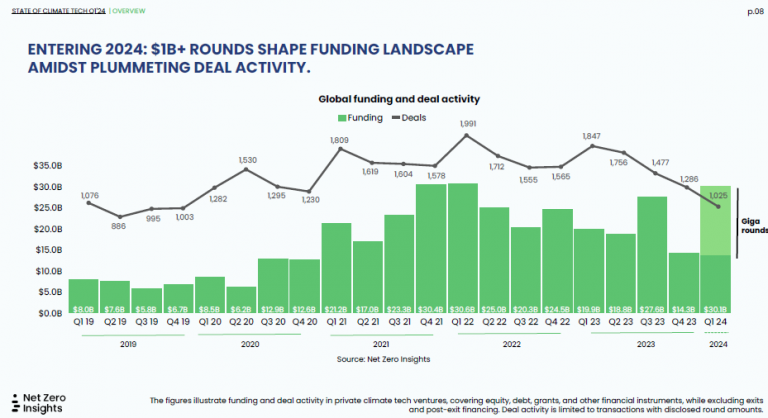

- The first quarter of 2024 sees the highest funding activity, driven by a few European outliers (Europe took about 70%), but continues to see free-falling deal activity consistent with 2023’s trends.

- Over 60% of total funding is non-dilutive (debt).

- The market focused on the deployment of later-stage physical solutions.

- Global funding shifts from digital adoption to physical breakthroughs.

- Among all stages all declining QoQ, series A and B were hit hardest, dropping by 30% compared with the same period of 2023.

- Investors deal activities and M&A maintain consistency and resiliency.

- “Europe is emerging as a strong contender in the global mega-round scene, bolstered by a wave of domestic investors pouring capital into the region’s burgeoning climate tech sector. Large giga-rounds ($1B+) raised by Northvolt, Automotive Cells Company, H2 Green Steel, Enpal, and IM Motors, are outliers for this quarter representing more than half of the quarter’s total funding.” — Highlights from Net Zero Insights. (see nuance in the report)

Deal Updates

Deal Evaluation on Connect X (from March)

We think now is NOT a good time to invest in Connect X. Thanks to everyone who participated in the process. Talk to me if you like to know more, or if you like to help them.

Last Demo Day (Apr.5) Recording and Interest Survey

SolarX – Investment Platform for Global Solar Projects (Pre-Seed)

MITO Materials – Lighter, Stronger, and Cost-Saving Carbon Fiber (Pre-A)

- Demo recording: https://youtu.be/l2L8VWVwaZE

- Fill Survey for Your Interests <- we’ll follow up.

Next Demo Day

Who would you like to invite to present to us on our next Demo Day? These 2 startups have been recommended to us so far. Shoot me an email about your suggestion. Stay tuned. (Demo Day is free for recommended startups)

- Power 2 Hydrogen – Building green Hydrogen with NASA, Shell, Enel, etc. (series A, lead investor confirmed and 75% filled) – Power to Hydrogen (P2H2) is simplifying hydrogen production and storage. Our hybrid liquid alkaline/AEM (anion exchange membrane) technology reduces the electrolysis stack cost by ~65%, eliminating the expensive and supply chain constrained metals needed like iridium, titanium, and platinum while integrating directly with variable, renewable energy. In addition to low-cost materials, the technology can produce hydrogen at 250-bar which can solve the cost challenges created from compressing and transporting hydrogen. The company has multiple paid pilots with Fortune 500 companies, its first industrial pilot contract signed, and a signed term sheet for their Series A round. The company was also recently the recipient of a $6.5M U.S. Department of Energy grant to prepare its manufacturing for GW-level production.

- Pix Force – Startup #1 in Artificial Intelligence in Brazil for 5 consecutive years, already serving Shell, and other major players in O&G. (series A) – PixForce leverages advanced computational vision and artificial intelligence to transform visual inspections within Industry 4.0. Our cutting-edge solutions, such as Pix Blue, utilize off-the-shelf ultraviolet and thermal cameras for the rapid and precise detection of oil leaks and spills in offshore operations. Pix Safety offers real-time workforce monitoring to reinforce health and safety regulation compliance. Meanwhile, Pix Grid delivers automated inspections of power substations, and Idexa provides intelligent data extraction from images and documents. Established in 2016 with a footprint in Brazil, the EU, and the United States, our 110 staff ensure that we deliver cheaper, faster, and more accurate solutions that outperform human capabilities, ultimately enhancing complex decision-making processes in the energy industry. ARR is several million.

NATO DIANA program is hosting Demo Days, called Outreach Days, in McLean, VA on Apr.25-26, 2024. Outreach Days will bring together the 44 deep tech start-ups (in 3 categories) from across the NATO Alliance currently within DIANA’s portfolio, selected out of 1,300 applicants. DIANA has a network of more than 200 affiliated accelerator sites and test centers. Although the deadline has passed, they are still accepting registration as of now. Would you like to be there?

Onboarding to the Digital Platform

Our team has curated a large volume of deal flow from quality deal sources, sign up to DueDash below to build your investor thesis and preference, and we’ll try to make quality recommendations matching that. Investors or startups all have total control over their data and visibility to the public.

Startups can sign up to update the Global League investor network and build their data rooms for free, just start by uploading a deck with basic sector and contact information to increase your exposure to investors.

Email: Contact@G-L.Ventures for communications.