Have you ever tried to communicate with someone whose language you don’t speak? You might get the message across by moving your limbs like a clown and overemphasizing words as if you were talking to a small child. This is what founders will feel like if they don’t know how to communicate with investors. Effective communication and data sharing between founders and investors are crucial for successful investor relations, especially during the due diligence process.

And one important aspect of that exchange will be your data room. This guide will explain startup data rooms for investors and how to streamline the sharing of critical documents and information. From its significance, required structure, expectations, and how you can get started with your data room on DueDash.

What is a data room exactly?

A data room is a virtual repository of key documents that offer a comprehensive view of a startup’s current status, potential, and growth trajectory. The data room becomes more than just a storage space; it’s a dynamic, interactive environment where startups can present their story, success and data points in a structured manner. It includes not just historical data, but forward-looking statements, projections, and strategic plans that give investors a sense of where the startup is headed. Additionally, it allows for real-time updates and modifications, ensuring that the information remains current and relevant. In a data room, every document, from financial statements to market analysis, contributes to a holistic view of the startup, enabling investors to make well-informed investment decisions.

Interesting fact: While the exact number of startup data rooms and due diligence processes are hard to quantify, we can use selected data points to glimpse at the sheer scale of it. According to Crunchbase in the US last year over 4000 startup investments took place at early stages, with many investors receiving hundred if not thousands of deals each year US early stage investors might have gone through over 1Mn data rooms in 2023 alone. And 2023 has been a low point in funding terms in recent years.

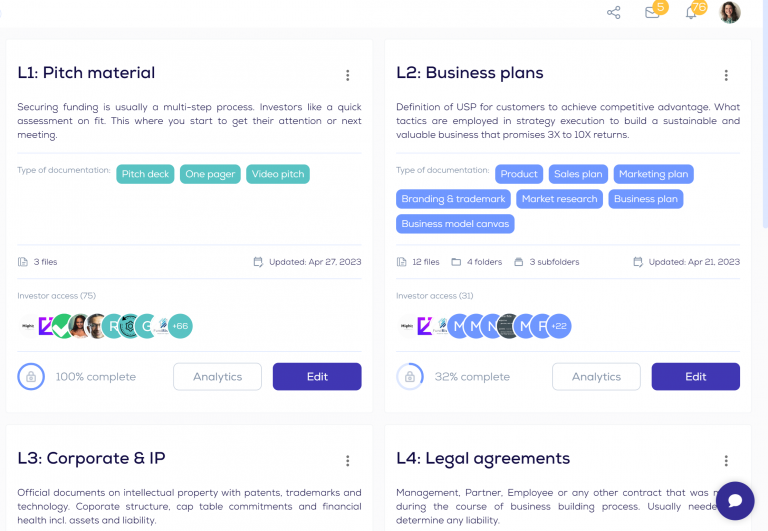

What goes into your data room? Essential data room contents include:

- Pitch materials (pitch deck, one-pager, video pitch)

- Business, sales, and marketing strategies

- Financial projections and current status

- Technical architecture and product/service details

- Legal documents

- KPIs

Importance of Startup Data Rooms for Investors

Why are data rooms so vital in the startup ecosystem? Investors are not asking for all tha data because they enjoy reading your financial statements. Data rooms serve multiple key functions:

Data Verification

Startups need to back their claims with solid data, allowing for a thorough assessment. This process is vital as it provides tangible evidence of a startup’s performance, market position, and future potential. Accurate and detailed data helps in building a narrative that is both compelling and credible. For investors, this means a reliable basis for evaluation, minimizing risks associated with investing in early-stage companies. No investor likes getting bad surprises after they invest in a firm, so they do their homework thoroughly.

Structured Review

Data rooms provide a clear, organized way for investors to examine a startup’s documents. This structured approach is crucial in the due diligence process. It ensures that all relevant information is easily accessible and systematically arranged, reducing the time and effort required to understand all relevant parts of a startup’s business – might it be strategic plans, product and financial data or legal documents. A well-organized data room reflects the professionalism and preparedness of a startup, increasing confidence in the founding team. Investors can make informed decisions quickly, which is especially critical with all the data we are flooded with every day and our busy schedules.

Comparability and Trust

Data rooms also enable investors to compare different startups and foster trust in a startup’s potential and execution capabilities. By providing a standardized format for presenting information, data rooms allow investors to efficiently assess and compare various investment opportunities on a like-for-like basis. This comparability is essential in identifying standout startups in a crowded market. Furthermore, transparency and thorough documentation in a data room build investor confidence. It demonstrates a startup’s commitment to openness and accountability, which are key foundations of trust in any investor-founder relationship.

Expectations in Data Rooms

What do investors expect from a data room? More than just a pitch deck attachment in an email landing in their spam inbox.

Simple Access

Investors expect easy navigation and the ability to find relevant documents in a data room. This simplicity is crucial as it allows investors to focus on analyzing the content rather than struggling with the interface. An intuitive layout, clear categorization, and a user-friendly design are essential elements of an effective data room. These save time and reduce frustration, making the due diligence process smoother and more efficient. Additionally, the ease of access to critical documents reflects a startup’s understanding of investors’ time and and their commitment to transparency. A streamlined data room enhances the overall investor experience.

Completeness

Investors want all necessary data and documents to be readily available in the data room. This completeness ensures that they have a full picture of the startup’s business, without the need to request additional information, which can delay the evaluation process. A comprehensive data room can include a large quantity of documents. The depth and breadth of information available give investors confidence that they are making an informed decision. Moreover, a complete set of documents shows that the startup is thorough and meticulous, qualities that are highly valued in business operations and management. Incomplete data can lead to doubts and missed opportunities, whereas a fully stocked data room can significantly enhance a startup’s credibility.

Dynamic Data

Investors expect the information in a data room to be up-to-date, reflecting the current state of the startup. Dynamic data is vital as it shows the latest developments within the company, including recent achievements, updated financials, and current market conditions. This real-time information is critical for investors to assess the ongoing viability and growth potential of a startup. It also demonstrates a startup’s commitment to keeping its stakeholders informed and engaged. Regular updates to the data room signal that the company is active, responsive, and adaptable to changes. This not only builds trust but also provides investors with the assurance that they are basing their decisions on the most current and accurate data available.

Typical Issues and Challenges

Never make the same mistake twice is common advice given. But what are mistakes many founders make and you definitely don’t want to do?

Lack of Knowledge and Preparation

A common challenge for many founders is not knowing where to start or what exactly investors are looking for in a data room. This gap in understanding can lead to inadequate preparation and a failure to meet investor expectations. Without a clear grasp of the required documents, financial data, and other critical information, founders may struggle to present their startups compellingly. This lack of preparedness not only hinders the chances of securing investment but can also reflect poorly on the founders’ overall business acumen. To overcome this, founders should educate themselves on standard industry practices, perhaps seeking advice from mentors and using resources such as this guide, ensuring you are well-equipped to meet investor demands.

Delayed Data Room Setup

Often, founders delay setting up a well-structured data room, not realizing its importance until an investor expresses interest in conducting due diligence. This procrastination can result in a frantic rush to compile documents and information, leading to errors and oversights. Such hastily prepared data rooms are likely to leave a negative impression on investors, who may view the lack of readiness as a red flag. It’s important for founders to anticipate investor needs and prepare their data room well in advance. This proactive approach not only avoids last-minute stress but also can make a startup appear more investable.

Outdated Data Room Content

Another challenge is the failure to regularly update the data room. Keeping the data room stale with outdated information can significantly hinder a startup’s investment prospects. Investors rely on current and accurate data to make informed decisions. Outdated information can lead to misinformed assessments or suggest a lack of ongoing activity and progress within the startup. Regular updates are crucial to maintain investor interest and trust. By consistently refreshing the data room, founders can ensure that investors have the most relevant and recent information, reflecting current growth and responsiveness to market changes.

Benefits of DueDash

What is the best way now to start setting up, managing and sharing your data room? You don’t have to look far. DueDash provides a full-blown data room for any startup interacting with investors. Utilizing DueDash’s data room offers several advantages:

- Centralized data management: Keep all your investor data structured in one place. Investors always know where to view your documents and also your team can easily check if any documents are missing or data needs updating.

- Collaborative features for team members: Work together with your team members, easily ensure that all necessary work gets done and no communication gaps open up inside your team, that could derail conversations with investors.

- Pre-defined structure for document organization: Don’t second guess how and where to set up documents, we give you a clear structure to follow to put documents where investors expect them and they can find anything they require for their due diligence.

- Detailed analytics on investor engagement: Understand who is accessing your data, when and for how long they are going through documents. Take the right insights to follow up with intent and improve your data according to the actual usage of investors.

- Simplified updating process: An investor needs updated information or larger changes require a new version? Easily upload the latest version of your documents while keeping your structure and analytics.

How to Use DueDash’s Data Room

You want to set up your data room on DueDash? Follow these simple steps to get started:

- Account Creation: Start by setting up your DueDash account or login into your existing account.

- Navigate to Data Room: Find the data room option in the menu on the left side.

- Understand the Structure: Familiarize yourself with the layout, such as the four data room levels and required documents.

- Document Management: Assess, upload, and plan for document creation and updates.

- Share with Investors: Grant access to your data room and monitor updates.

Set up your data room today

Now that you know everything you need to know about startup data rooms for investors, it’s time to make sure your data room is ready for action. Login into your DueDash account or signup to get started and show investors one of the best data rooms they have ever seen!