Nobody likes losing money. Even more so, when you invested millions of dollars with the hope of multiplying that capital multiple times over.

Investors putting their faith in startup founders prefer not to lose their investments. This means they need to ensure that their money is in safe hands rather than feeling as if they had bet on a turtle race, finding out 5 years later if the turtle is still alive.

For that purpose, investors try to analyze which startups are “investable.” A company that deserves support and will be able to return capital with additional returns.

How do investors decide if a startup is investable and why do so many founders struggle with it? That’s what we will explore in this guide.

What exactly is Investability?

Investability refers to how investors perceive the potential of a startup to succeed and be a sensible investment opportunity. It’s essentially about convincing investors that your business has value, a strong team, customer interest, and a viable growth path. Understanding investability is crucial for startups and investors alike.

To assess investability investors use various frameworks or data sets that they believe to be deciding factors for a firm’s growth and survival. Often investors rely here on their previous experience either as founders themselves or with the work they have done as investors.

While investing can be as much an art form as it is data-driven analysis, sophisticated investors want to ensure that it’s not just their gut feeling that compels them to invest, they want to be able to argue that the risk is worth it.

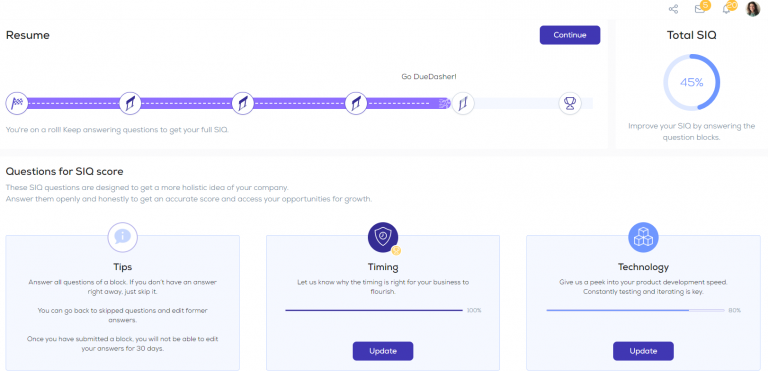

A common framework used here is the 5T model. It consists of Team, Timining, Traction, Technology, and TAM (for market size). These 5 aspects enable an investor to get a thorough picture of your startup. Is your team compatible and the right fit for this market and product? Is it the right time to enter the market, what factors make it appealing? How much revenue have you made, did you onboard many users and customers, are they happy with your solution? Do you have a defensible technology and is it scalable? Is the market big enough as well as its growth rate? These are all questions that investors would want to answer to decide if you are investable.

Why is investability assessment important?

As an investor needs to see a startup as investable to back them there are many reasons why founders should work on their investability.

Assessing survivability

Investors can gauge how “survivable” a startup is by analyzing factors such as its financial health, market position, and growth prospects. This would enable investors to identify startups with a higher likelihood of long-term success and avoid companies at risk of failing.

Data-based decision making

Especially in early-stage investing, many decisions are made with a gut feeling, but investors need to defend their investment against other investors, their colleagues if they are part of an institutional investment firm, and also against LPs. If a startup provides compelling data it makes it easier for the investors to come on board and argue against potential risks.

Building trust and credibility

Startups showing proper data demonstrate their commitment to transparency, accountability, and professionalism. By providing investors with comprehensive and accurate information about your business, entrepreneurs can build trust and credibility, fostering stronger relationships with potential investors and increasing their chances of securing funding.

Insights for founders

Founders would gain insights into areas where they can improve their business and make themselves more attractive to investors. As most investors prefer to share fewer insights into their decision-making and the reasons they reject a startup, it helps if a founder can assess themselves where they are lacking.

Mitigating risk

Startups inherently carry a high level of risk, and investability assessment serves as a risk management tool for investors. By thoroughly analyzing various aspects of a startup, such as its market traction, competitive advantage, and financial projections, investors can identify potential risks and uncertainties, thereby minimizing the chances of making unwise investment decisions.

What is expected?

Investors are busy, so an analysis and decision need to be done quickly. Investors appreciate it if you make it easy for them to assess your investability.

Accurate information

Investors expect founders to provide updated and accurate core data about their startup’s performance. Don’t try to beautify bad data or lie about numbers, data asymmetry is easily spotted by many investors and can not only destroy your credibility but also bring you into legal trouble.

Simple accessibility

All the necessary information & documents investors want to see should be easily accessible and reviewable. If a founder makes it difficult to access these investors might lose interest or wonder if this is on purpose.

Dynamic data

Accurate evaluation is only possible with recent data. Startups’ info is changing rapidly, so ensure that what you share with investors is giving a real current picture.

Comparability

Investors want to compare your firm’s data and performance with market data and other startups – give them clear numbers and make what you share digestible so investors are easily able to see why your company is a better investment than other options on the table.

Issues & challenges

When it comes to highlighting one’s investability, there are potential issues founders need to prepare for.

Inefficient communication

Not all founders possess strong storytelling or presentation skills, making it challenging to effectively communicate the value proposition to investors. Even if your company is objectively investable, if it doesn’t come across to investors as such, you are effectively uninvestable.

Resource constraints

Limited resources may hinder startups from providing comprehensive and up-to-date data requested by investors during the evaluation process. Founders wonder how to manage and maintain all that data next to all the busy and demanding work required to keep the company afloat. And then every time an investor wants data you start preparing and sharing data anew

Subjective evaluation criteria

Investors sometimes rely on subjective criteria that founders might not know which makes it difficult for them to bring across what is needed to win over an investor’s heart and mind.

Lengthy due diligence process

Startups may face delays and uncertainties during due diligence, prolonging the time to secure investment and diverting resources. And the longer this process takes, the higher the chance inventors could find holes in a startup’s narrative like a Swiss cheese or start seeing the firm in a more negative light.

Benefits of DueDash

What is the best way now to start assessing your investability with all the above-mentioned elements in mind? You don’t have to look far. DueDash enables you to prepare all required data to see how investable you are and become more investable.

- Data management system: We provide you with one centralized system where you have all the data and documents investors would require from you. Easily manage and share these to highlight your investability.

- Visualized comparable data: Data on DueDash is standardized and visually shown to investors to easily assess your current performance, potential, and fit with their thesis. You save investor’s time and make it simple for them.

- Effortless information updating: Founders can easily update their core information such as the 5T within the system. This allows founders to always highlight their recent data to investors.

- Self-evaluation tool: Use our self-assessment tool to determine your Startup Investability Quotient (SIQ), which provides an approximate measure of your startup’s attractiveness to investors. The SIQ is based on the aforementioned 5T model. The higher the score, the higher the startup’s investability.

- Building Trust through Data: Investors develop trust with founders through data-driven relationships. By providing transparent and reliable data founders demonstrate their commitment to accountability and facilitate stronger partnerships with investors.

How to use DueDash to be more investable

Steps to start using DueDash for data management:

- Create your profile: Begin by setting up your DueDash account.

- Collect Relevant Data: Complete your DueDash profile with core data, such as the 5Ts (Team, Timing, Traction, Technology, and Total Addressable Market) and Key Performance Indicators (KPIs) under the Metrics & Funding section

- Upload Core Documents: Utilize the data room feature to upload and maintain core documents at different levels.

- Start Sharing Information: Once your DD profile is complete, start sharing information with investors. Grant access to investors using sharing your DD profile link.

- React to Investor Queries: Respond to investor questions and requests for additional information by allowing access to Data room levels or through inbuilt messaging systems.

- Send out updates: This data you collect and manage can be sent as part of investor updates, simplifying your investor reporting.

- Keep data up to date: Check back in regular intervals to keep your data current and relevant.

Start improving your investability!

Now that you know everything about investability, DueDash offers you the ability to easily improve your 5Ts & further data as well as update investors all in one place. Show the investors how investable you are!