Too many founders are applying to VC Funds not knowing their expectations and then wondering why they are rejected.

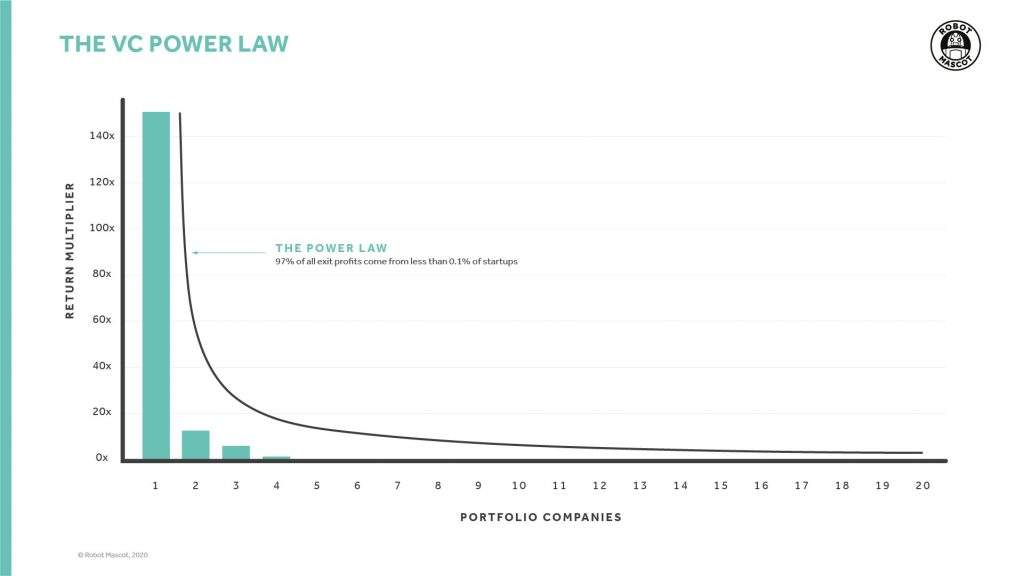

The problem is that they don’t understand the VC power law.

It’s a different ball game than pitching to Angels. Angels are happy with the potential for a 10x return, for VCs, they have to see the potential for 100x or more.

Let’s assume we have a fund of £50m and they are targeting a 3x return.

“But hang on, didn’t you just say they wanted 100x?”

Here’s the difference. In this example, the whole fund has to make a 3x return (£150m). In order to achieve that your business must make the VC at least a 150x return. Here’s why:

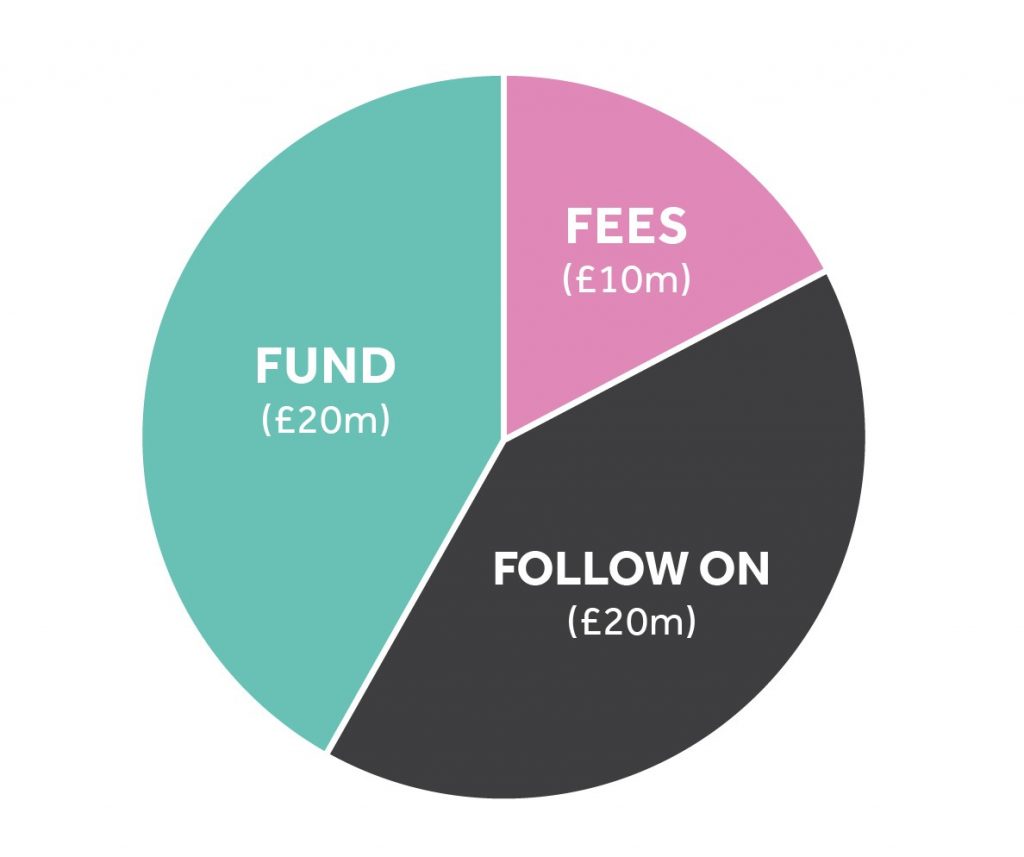

By the time the VC sets aside £10m cash to cover fees and £20m to commit to follow on rounds for the portfolio, they’ll have £20m left to invest. Let’s assume they invest in around 20 companies at £1m each.

Of those 20 companies, they expect 2 to make a 5-10x return.

“Nice, that’s the 3x achieved then”

Nope. A 5-10x return on just 2 companies merely covers 3-10% of the expected return (£3m-£10m of the £150m they need).

They will expect 5 to break even. And 12 to fail.

That leaves one company to save their arse and bring the return.

In order to cover the original cost of the fund, the other investments that didn’t work out, the follow on investments that didn’t work out and still get a 3x return on the whole fund come the end, the return from that one business has to be in the region of £150m.

That’s a 150x return from just one business.

Assuming a 10% equity stake the VC needs a £1.5bn exit.

“Wait, what about dilution?”

Good call. Assuming that further rounds are required and this dilutes the shareholding by 50%. The VC is actually needing a £3bn exit to get their 3x return.

For every single business a VC invests in, they are needing to see the kind of potential that will lead to 150x return. Knowing only one of the companies they are investing in will actually make it. I call it the VC Power Law.

And this hypothetical example is a small fund investing just £1m at a time to keep the math simple. Many VCs invest £2m – £10m per deal. So the returns needed are likely to be even higher.

Before sending your pitch out to VCs it’s important to understand what they are looking for and how they differ from Angels.

Make sure your business plan and financial projections reflect, and have the potential to achieve, what the VCs are looking for.

If your business can’t achieve 100x or more, or building that kind of business just isn’t for you, then VCs are probably not the right route.

Instead, you may be better off sticking with Angels and Family Offices.

James Church

Author of Investable Entrepreneur. #1 Amazon Best Seller. | International Speaker | Co-founder of Robot Mascot