There are tons of articles out there talking about how to design a pitchdeck for investors. I want to share a structured way of creating your pitchdeck from the perspective of investors. One mistake I have seen many founders make is that they use one deck for sending to investors and also the same while presenting in a pitching event. When you are presenting, you have the option of taking more liberties in how you present. But, when you are sending your deck, it should be as explanatory as possible.

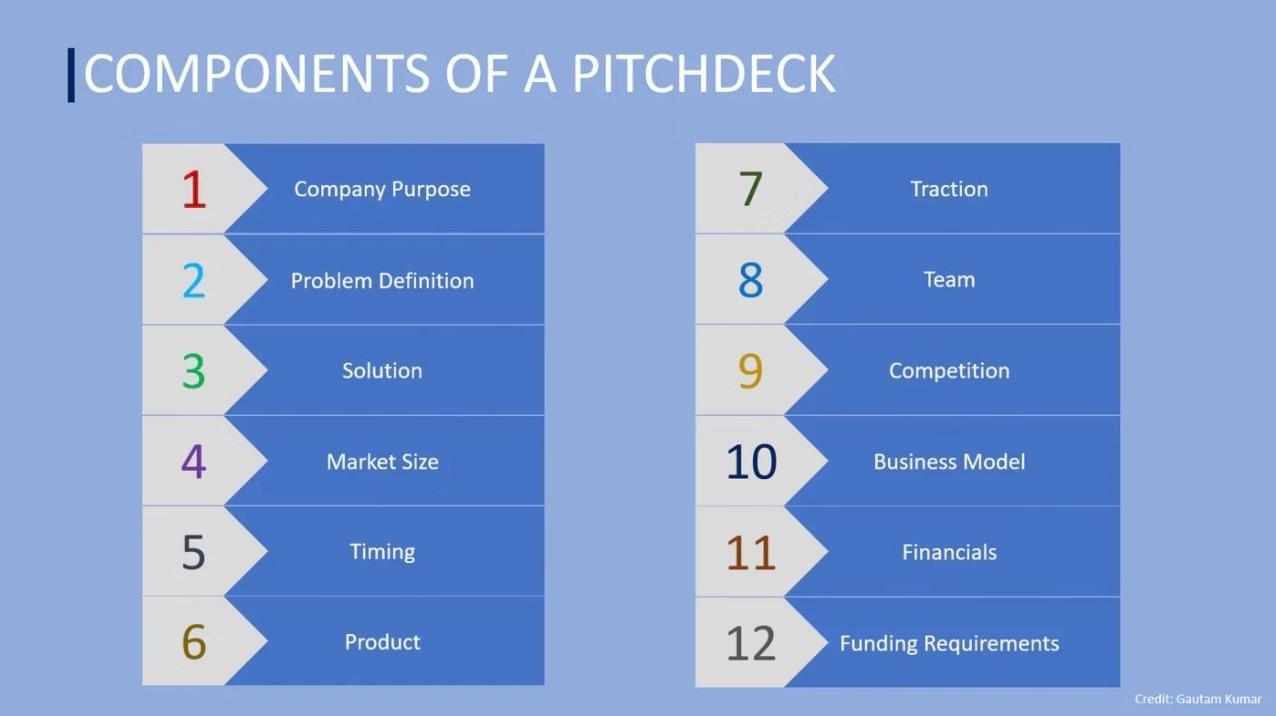

The pitchdeck should be 15-20 slides long and should have the following sections:

On average the pre-seed funding takes about 20.5 weeks to complete and a survey by docsend showed that 51% of successful decks take about 16 weeks to finish the pre-seed funding round. The most important sections of the deck are purpose, problem, solution, market size, team and business model.

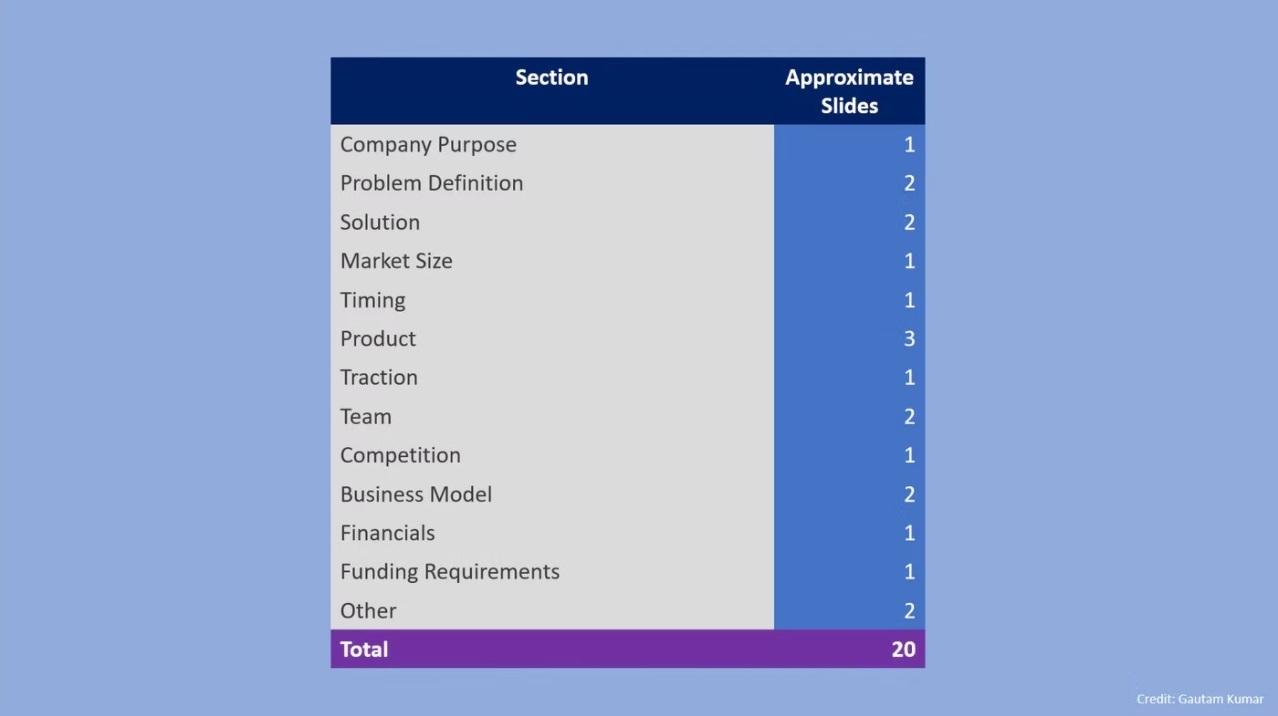

So how many slides should you allot to each of the sections I listed above?

Here is a rough breakdown.

Company Purpose– What is the mission and vision of the company? How strong and coherent is it?

Problem definition– What kind of problem are they solving and especially how big is this problem?

Market Size– How big is the market? Can this company do $50-100 Million in yearly revenue in the next 6-7 years? As an angel investor can I get 100x+ return?

Solution– Does the solution make sense? How viable is it?

Timing– Why now?

Product– Is there product market fit?

Traction– Is there some revenue or signed contract or some interest from target consumer group?

Team– Is the team capable of scaling up? How does the experience of different team members compliment each other?

Competition– How are you differentiated from your competition? Too much competition or too less competition is not a good indicator. The sweet spot is medium competition.

Business Model– Are the revenue streams properly defined?

Financials– Not the most important slide, mostly investors want to know your burn rate?

Funding Requirements– Are the funding requirements justified and will the amount let the company achieve the necessary growth in the next 16-18 months? How will the funds be disposed?

That will be all for this article. In my next article I will talk about the VC investment process and how VCs screen a startup.

Gautam Kumar

Pre-Seed - Seed Investments | Sector Agnostic | VC Research | Startup Mentor