The private markets have performed better over the past two decades than the public markets. And LP allocations increasingly go to a large extent to existing GPs with growing fund sizes.

As a result of increased dry powder, more funds are competing for deals, leading to higher valuations, and larger deals.

Due to this and the recent downturn in the market, on one side LPs are demanding transparency as they invest more capital and on the other side the operational complexity is growing with fund sizes.

Pressure is mounting on the industry

Personal connections and spreadsheets have historically driven private markets. Compared to the public markets, the private markets have performed better over the past two decades.

If this is an old-school industry that is overperforming, then why would technology be needed? Competitive industries often have the same problem and follow the old adage that competition breeds success.

So here’s what we’ve learned:

Because of private markets’ outperformance, LPs are investing more capital in them, leading to more funds raising money.

As a result, LPs increased their exposure to earlier-stage private investing.

Private market allocations by LPs are increasingly going to existing GPs with growing fund sizes.

Increasing inflows of new capital are driving established firms to raise more funds, increasing fund size and complexity.

In response to increased dry powder and more funds competing for deals, valuations and with bigger deal sizes.

The recent market downturn has led investors to seek out lower-cost proprietary investments, as returns appear to be diminishing.

As LPs seek to prioritize investment opportunities, operational due diligence is on the rise among them.

Additionally, emerging managers are convincing LPs that leveraging technology will help in building differentiated strategies and smart data will generate higher returns.

To build true proprietary deal flow engines, GPs are seeking new data sources, both internal and external (in addition to legacy solutions such as Crunchbase, and PitchBook).

GPs and LPs continued to formalize environmental, social, and governance (ESG) commitments in 2021: over half of total fundraising, the highest percentage ever flowed to firms with formal policies. (McKinsey Report 2022)

In order to gain a competitive advantage, improve operational efficiency, and make better decisions, data and analytics platforms have become increasingly important.

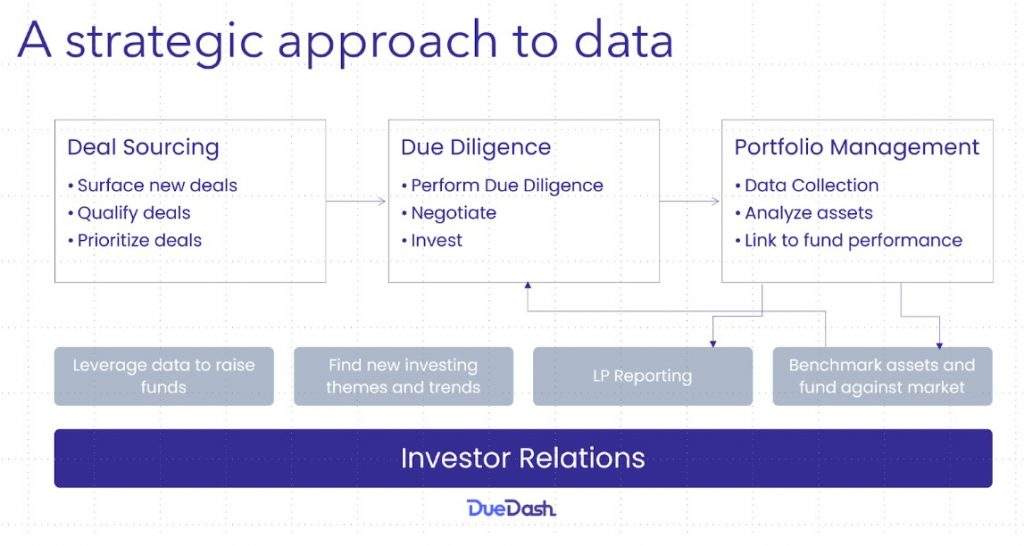

A strategic approach to data

In order to improve fund performance, how can data and analytics be leveraged? The more data you collect, the less effective it is unless it is used effectively. Better decision making can be done with structured data that is used properly.

Deal sourcing

Capital funds are chasing deals at an all-time high. The best companies continue to attract large numbers of investors despite shrinking valuations. It is imperative that investment firms develop a differentiated strategy for not only identifying the best investments, but also building strong relationships with potential winners. Even though it is difficult, it is not impossible. To identify and prequalify investment targets efficiently, the right workflow should be used along with a data-driven approach.

Due Diligence

While investors should never follow data blindly, the alternative is even riskier.

Additionally, firms should utilize their portfolio’s data to make decisions. Specifically, sector-specific investors can gain insight into how similar companies have fared over time by analyzing historical data from portfolio companies. Even though times are changing, every company has its own unique advantage in the face of a dynamically changing industry. In order to gain a comprehensive understanding of the market, investors need to combine historical portfolio data with the latest market data. A combination of internal and external data allows investors to conduct effective deal due diligence and choose companies that are most likely to succeed.

Portfolio Management

Investments aren’t the end of deal-making. The majority of investors reserve capital for future rounds (common in venture capital) or add-on acquisitions (common in mid-market buyouts). For effective reserve capital deployment, investors need industry-specific and portfolio-specific data. Understanding growth levers and opportunities can begin with portfolio company metrics, but for informed decisions that ultimately maximize fund performance, it is crucial to have a broader view of fund cash flow and external market opportunities as well as portfolio company data.

While data is critical to portfolio management, it isn’t the answer to all problems. The relationship between investors and their portfolio companies should be collaborative and mutually beneficial.

In addition to making data sharing seamless, companies should also benefit from this exchange. It is important for investors to share their insights, whether it is aggregated benchmarks, expertise or introductions for hiring talent or business growth. An investor’s extended network can be useful to companies in many ways.

Investor Relations

Many people think private markets are based on numbers, but in reality they are based on relationships. Inherently, investing is a risky endeavor, and the best capital allocators know this. The key to success is good processes, a competitive edge, and exceptional communication.

A general partner tries to anticipate the market trends to capitalize on shifting tides, which often involves raising funds with new strategies and segments, requiring a strong LP base. Even the best investors are capable of posting terrible losses, but whether they can recover depends on the trust they have built with their limited partners. A good track record, of course, is invaluable, but nothing is more important than relationships that are formed through open communication.

It is again important to remember that every GP’s success depends on the work they have already done. With performance as a baseline, consistent communication makes all the difference, and for that to happen, every investor needs the tools to collect, analyze, share, and act on data in line with best practices.

Our take

Each of these areas has a great deal of nuance. It’s really all about how you use data and technology to gain a competitive advantage in today’s world.

The key is to maximize your deal sourcing processes by leveraging internal and external data.

This ecosystem includes the venture fund’s team and the people around, such as the LP’s and startup founders. That’s why funds need a tool to manage collaborative engagement with them all.

Get in control of your data and stop flying blind. Learn how data and technology can enhance your operations by contacting us today.

Utilize DueDash to capture more proprietary internal data and collaborate with your portfolio and build proprietary deal sourcing for a better use of external market data.