The Institutional On Ramp for Founders

Fundraising is a full-time job that distracts from building your business. Our productized readiness kits provide the operational infrastructure to run a professional, efficient capital raise that gives investors confidence.

The Problem

For founders, fundraising is a high-stakes distraction from the core business. For investors, receiving inconsistent, disorganized information is a significant time sink and a critical red flag. This friction slows down the entire capital allocation process.

The Solution

DueDash provides founders with the productized infrastructure to run a capital raise with the same level of precision as an institutional-grade asset manager. This allows you to demonstrate operational excellence, build investor trust, and accelerate your fundraising cycle.

Control Your Narrative, Securely

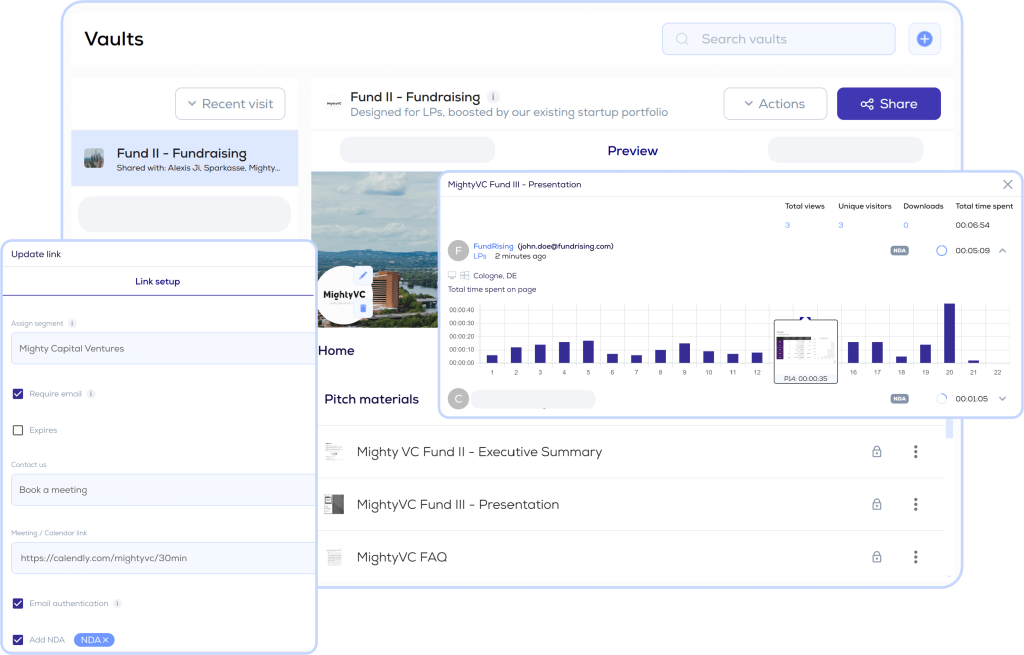

Control Your Narrative, Securely Body: Centralize all due diligence materials in a secure, branded data room. Go beyond simple file sharing with granular, role-based permissions, document watermarking, link expiry, and password protection. You control who sees what, and when.

Structured Pipeline & Communications

Move beyond spreadsheets. Manage your entire investor pipeline in a single, collaborative CRM. Track every interaction, automate follow-ups, and leverage our templates for professional, consistent investor updates that build trust and maintain momentum.

Turn Insights into an Advantage

Understand exactly how investors are engaging with your materials. Real time analytics and show you who is viewing your deck, where they are spending their time, and who is most engaged. Use these insights to proactively prepare for meetings and focus your efforts where they matter most.

It Signals Operator Quality

Founders who use professional tools to manage their raise demonstrate a commitment to process, data, and transparency. It's a powerful signal that you run the rest of your business with the same level of discipline.

It Streamlines Diligence

Providing investors with a well-organized, secure, and comprehensive data room from day one dramatically reduces friction. It makes their job easier, accelerates their decision-making process, and builds the confidence needed to close.

Investor Ready Kit

We package your raise with an IC-style memo, an investor-grade VDR, a risk report with remediation, and analytics—then (optionally) enable fit-based outreach under your brand. Non-custodial. Admin-of-record respected. Audit-ready.

DueDash is not a broker-dealer, investment adviser, transfer agent, custodian, or placement agent and does not provide legal, tax, or investment advice. All document execution, KYC/KYB, cash movement, and registers are operated by the client’s appointed administrator or licensed partners. DueDash surfaces statuses and records an audit trail for coordination purposes only.