From Strategy to Execution — Installed on Your Infrastructure

We productize institutional-grade capital readiness. Our expert team uses our proprietary AI agents to prepare your VDR, IC-style memo, and risk map. We then configure the DueDash platform and deliver a strategic playbook for your team to execute.

Model: Expert Configuration of the DueDash Stack

This is not a traditional consultancy. We provide a productized service where a dedicated pod of our experts (Engagement Lead, Research Analyst, RevOps Specialist) leverages our proprietary AI agents (MemoCraft™, DocIntel™, DealSense™) to build and configure a complete, institutional-grade capital-raising system directly within your DueDash workspace. The software provides the structure and telemetry; our team delivers the strategic artifacts and system configuration. Your team maintains 100% control of all investor communication and relationships.

Tier 1

The institutional foundation required to engage sophisticated investors. This program delivers the core artifacts and configured infrastructure for a professional process.

IC-Style Memo

A comprehensive investment memorandum, generated by MemoCraft™ and refined by our analysts, detailing your thesis, risks, TAM, unit economics, and milestones.

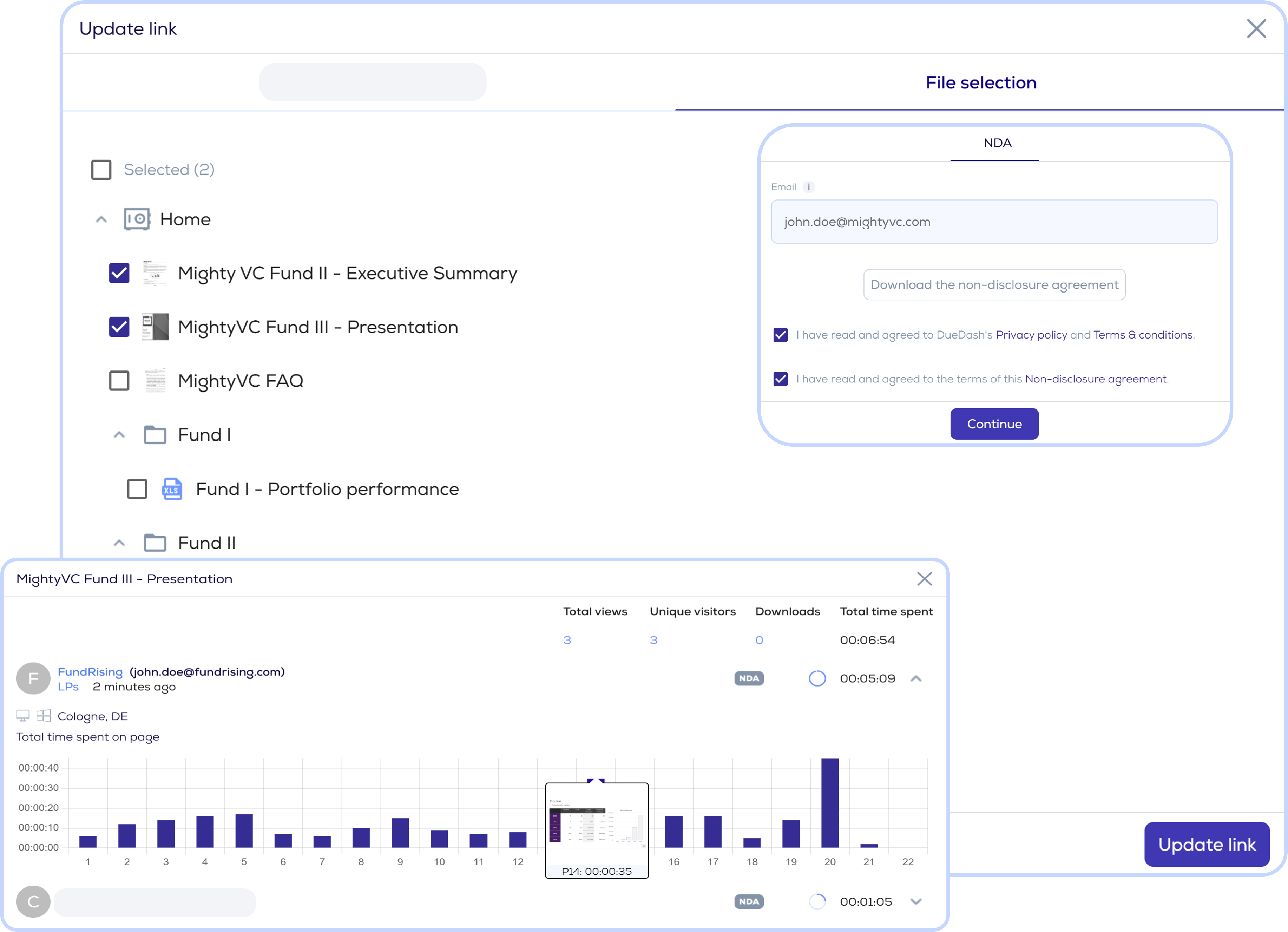

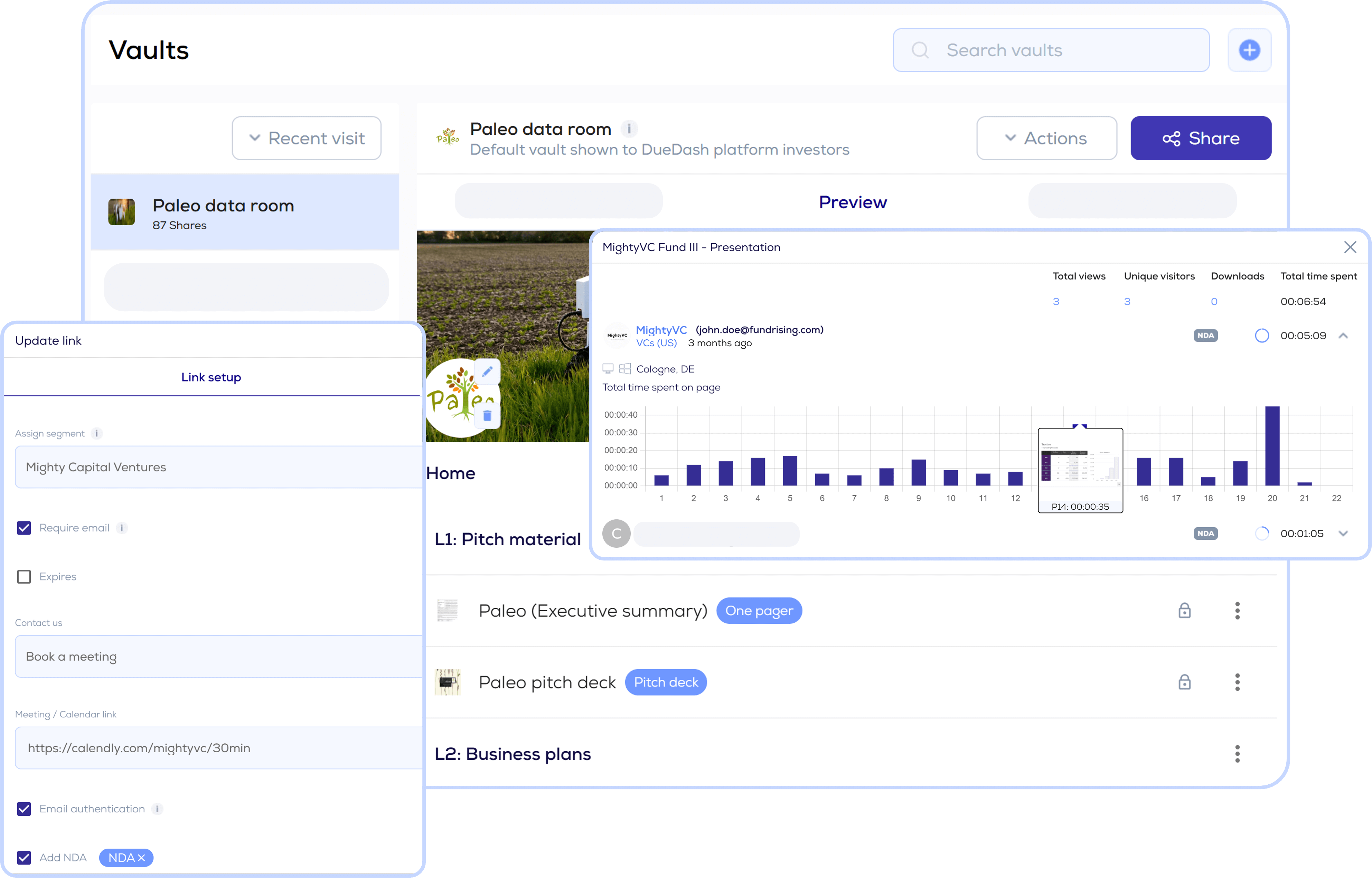

Investor-Grade VDR

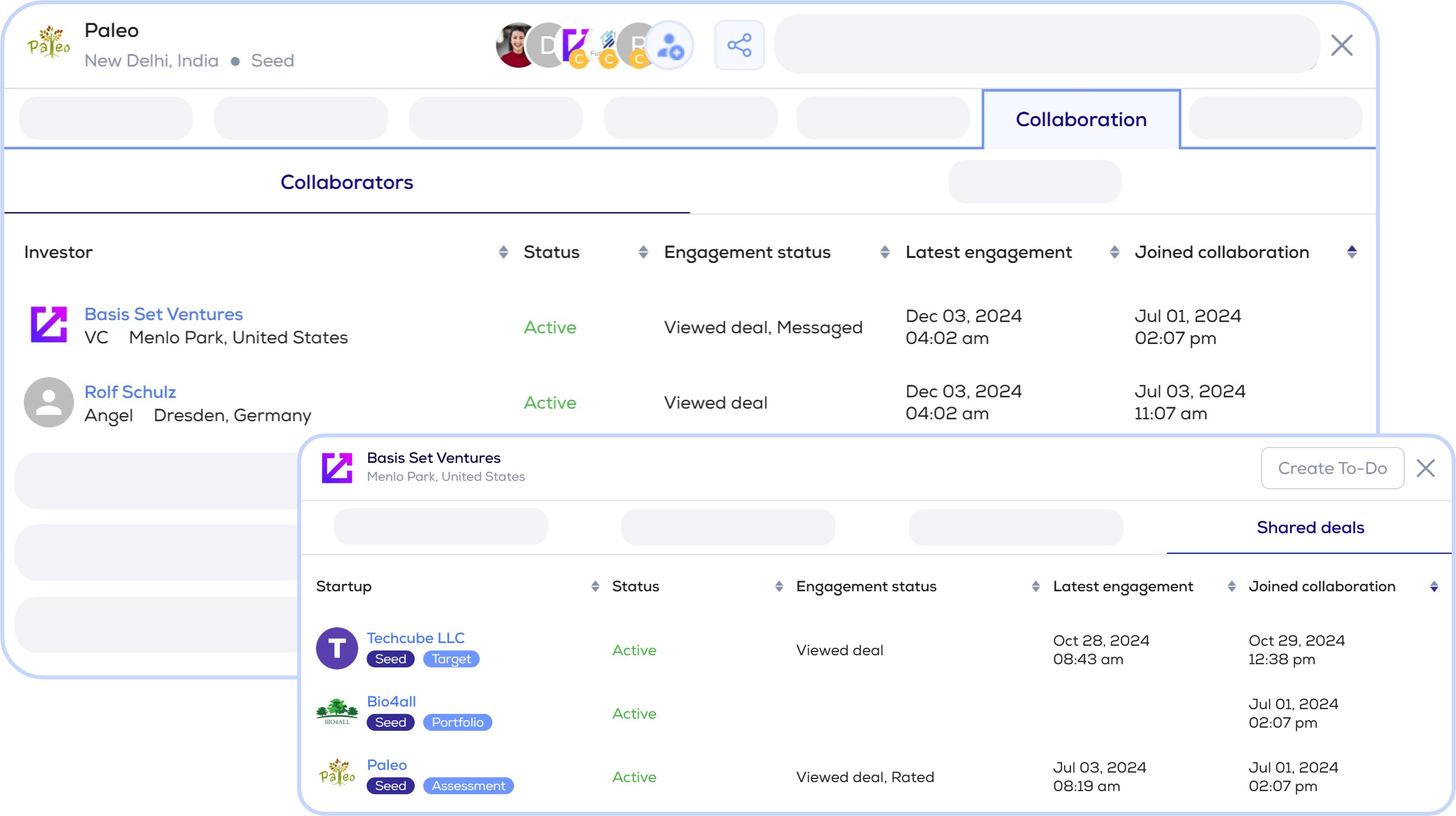

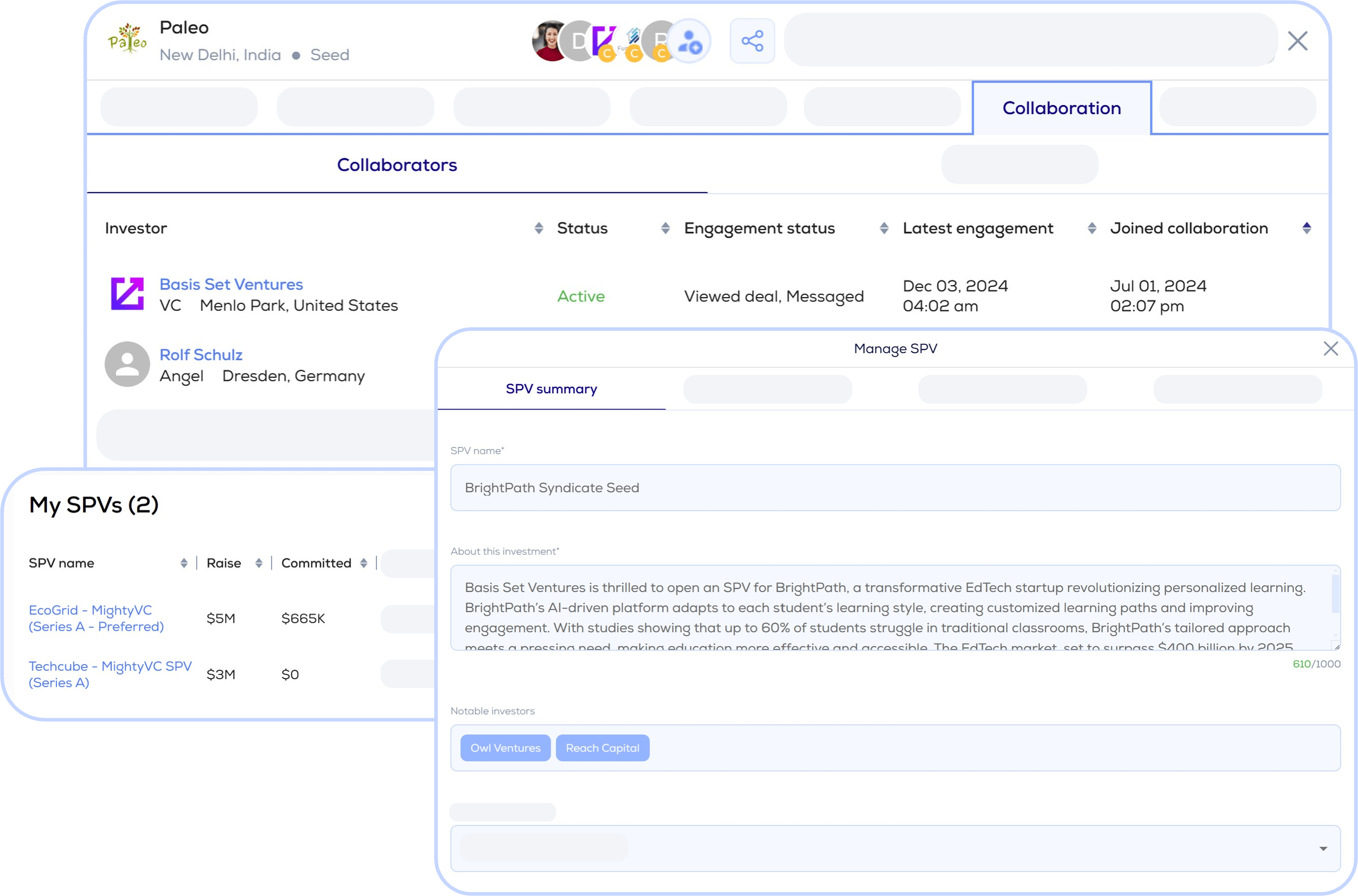

A fully configured virtual data room with a professional taxonomy, pre-set permissions, watermarking, and a structured Q&A workflow.

Gap & Risk Report

Leveraging our DocIntel™ analysis of your corporate documents, identifying non-standard terms, IP chain risks, and a prioritized remediation plan.

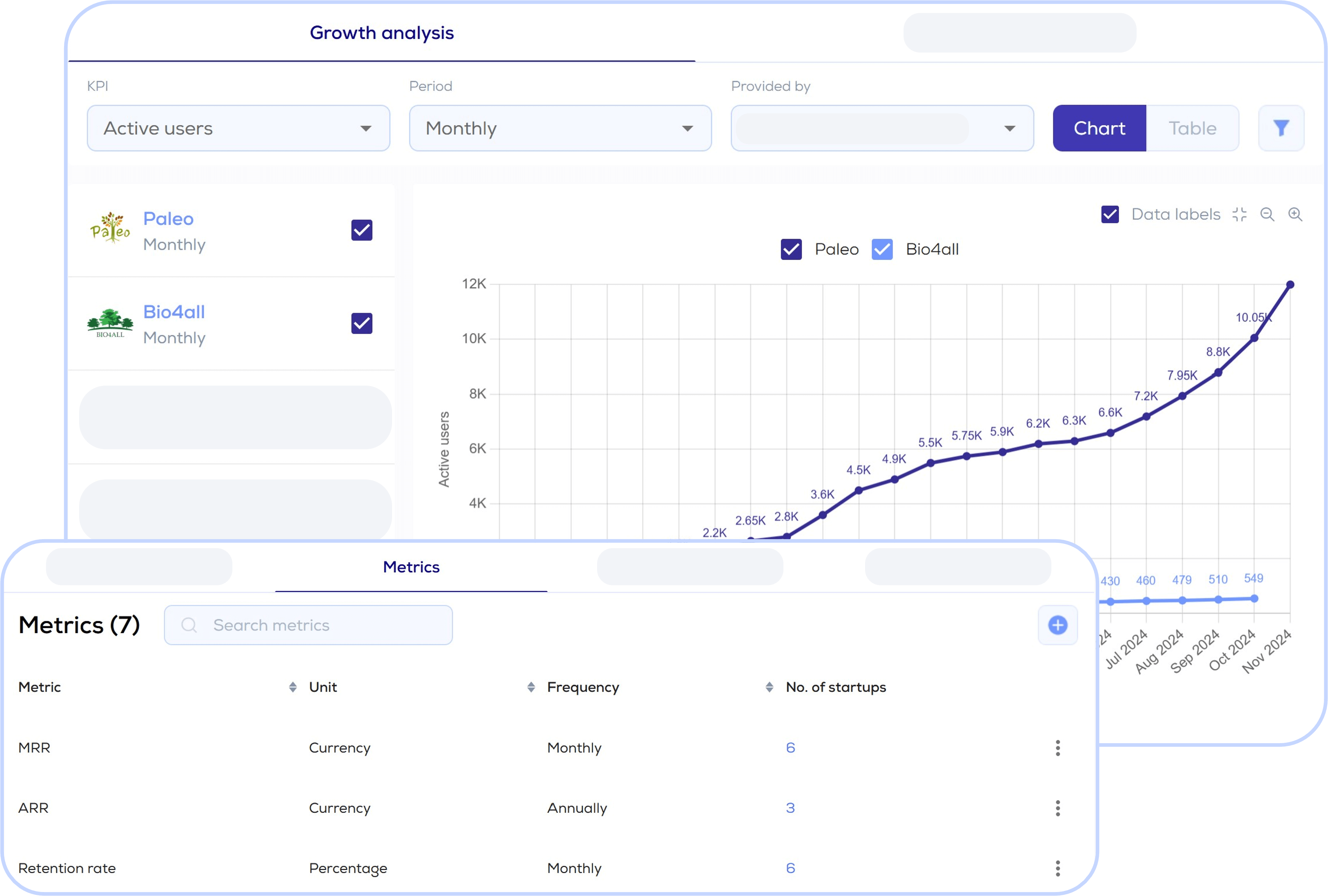

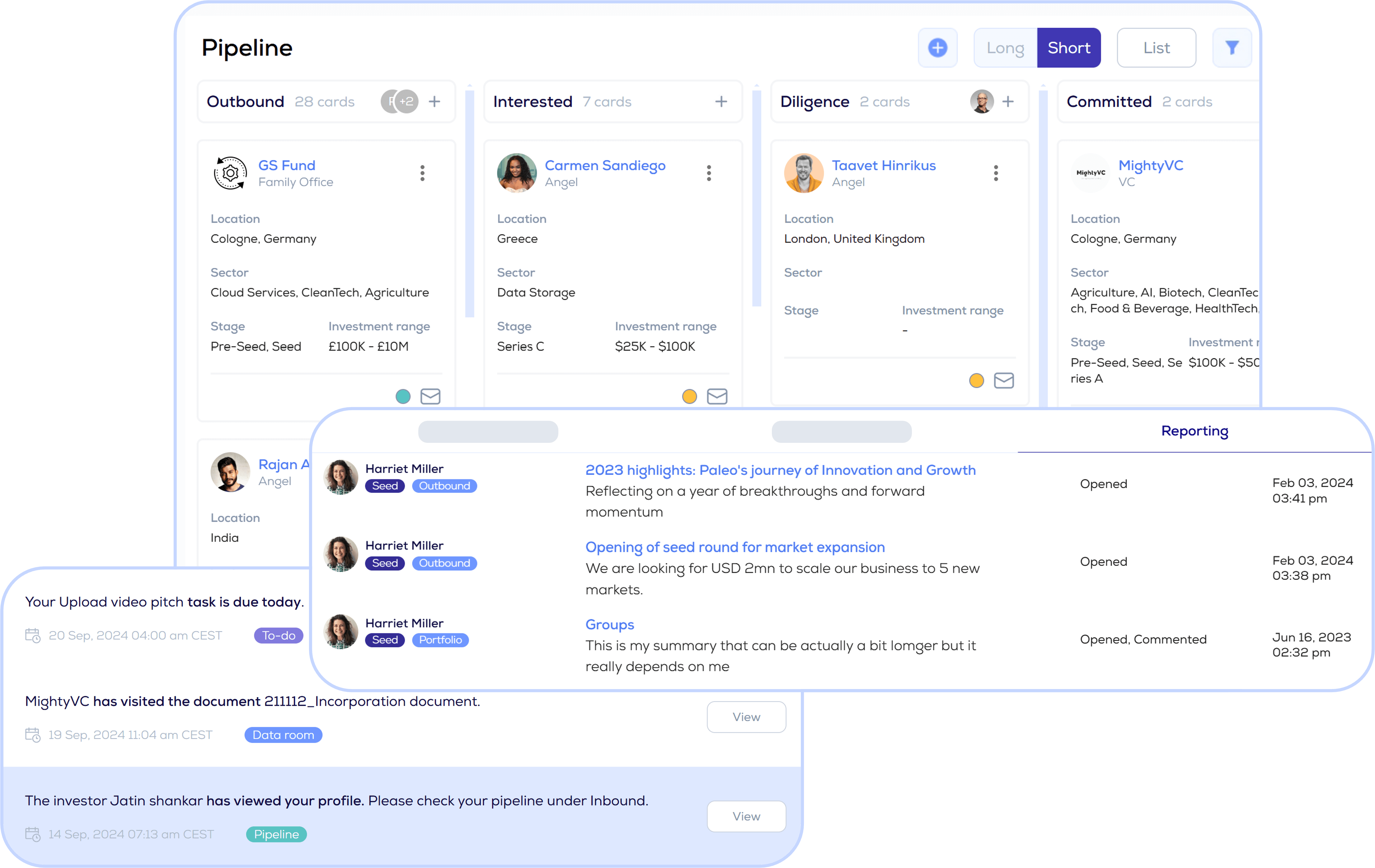

Analytics & Reporting Setup

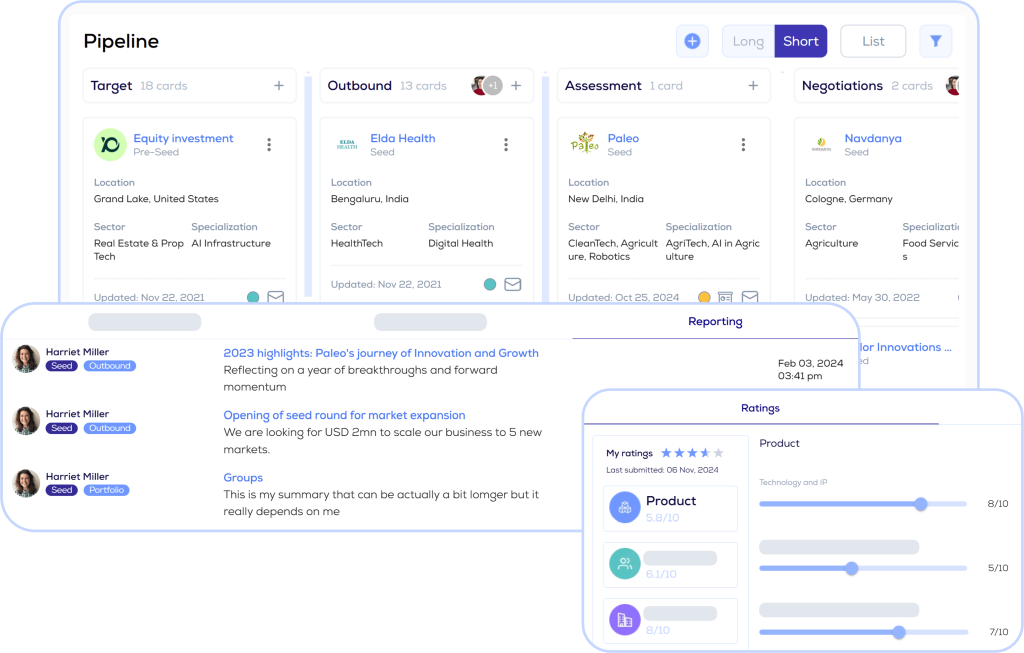

Configuration of page-level analytics, engagement tracking, and automated reporting dashboards.

Optional Teaser/NDA Pack

branded teaser + NDA routing (status mirrored from your e-signature provider)

Tier 2

A strategic add-on that equips your team with the intelligence and playbook to execute a fit-based, staged outreach campaign.

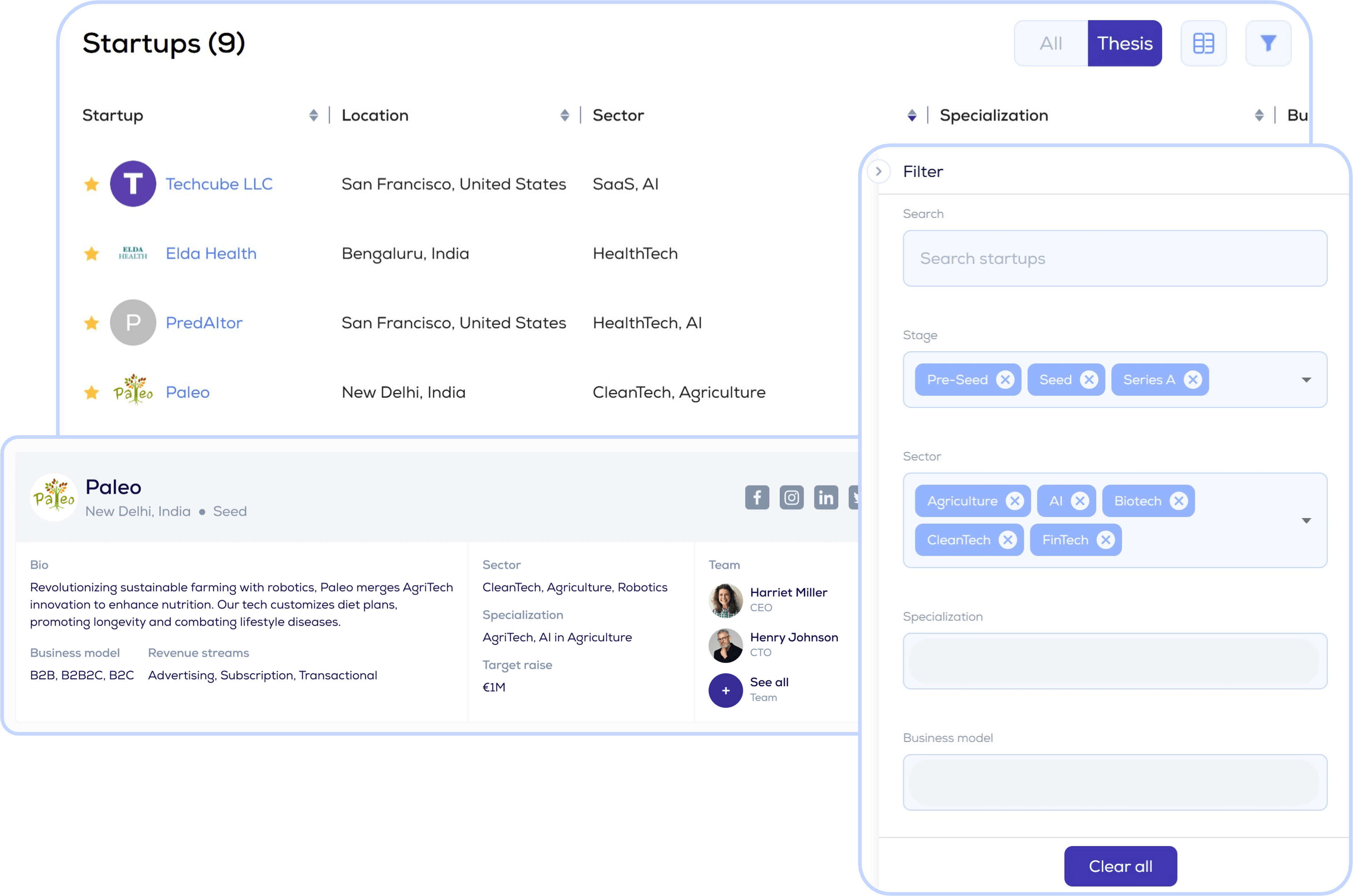

Target List & Rationale

A thesis-aligned, leveraging DealSense™ an AI-scored list of target investors, prioritized by sector, stage, check size, and geography.

Strategic Cohort Design

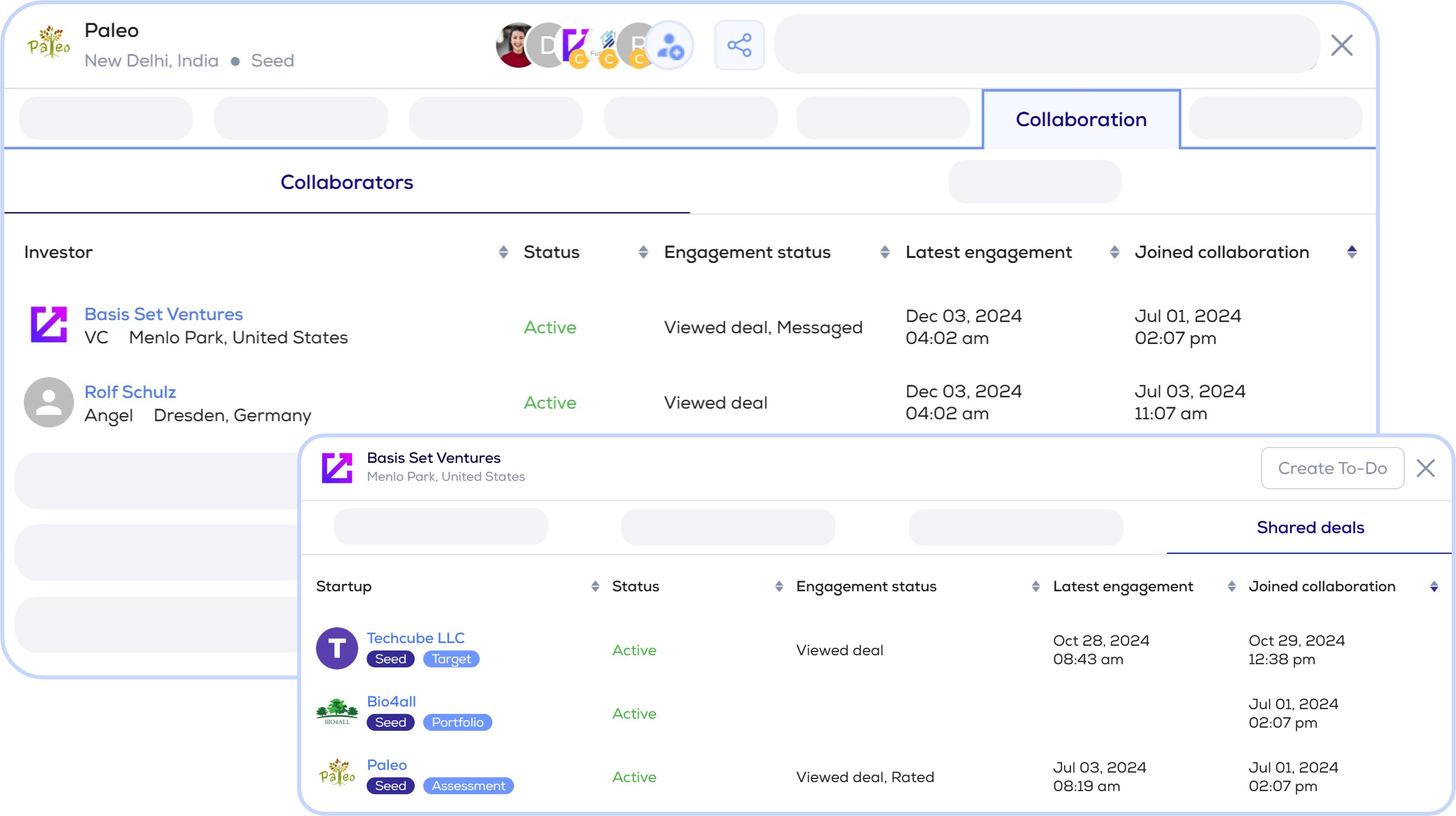

Configuration of staged access levels (Teaser → NDA → Full VDR) with permissions and expiries within your VDR.

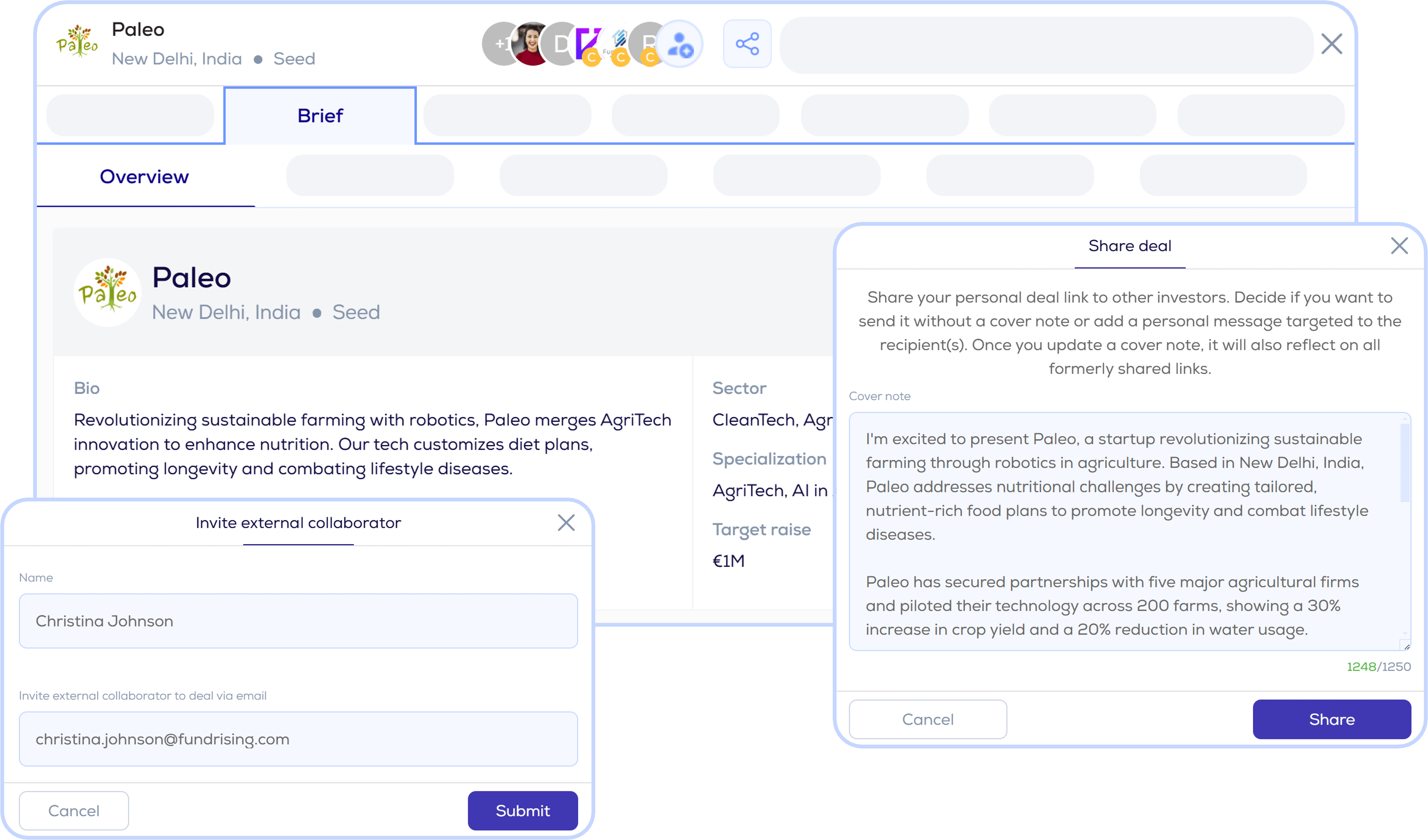

Outreach Playbook & Message Kit

A complete set of stage-specific email templates and intro scripts, crafted by our team and loaded into your workspace.

Warm-Intro Mapping

AI-assisted identification of mutual connectors within your network to prioritize relationship-driven outreach.

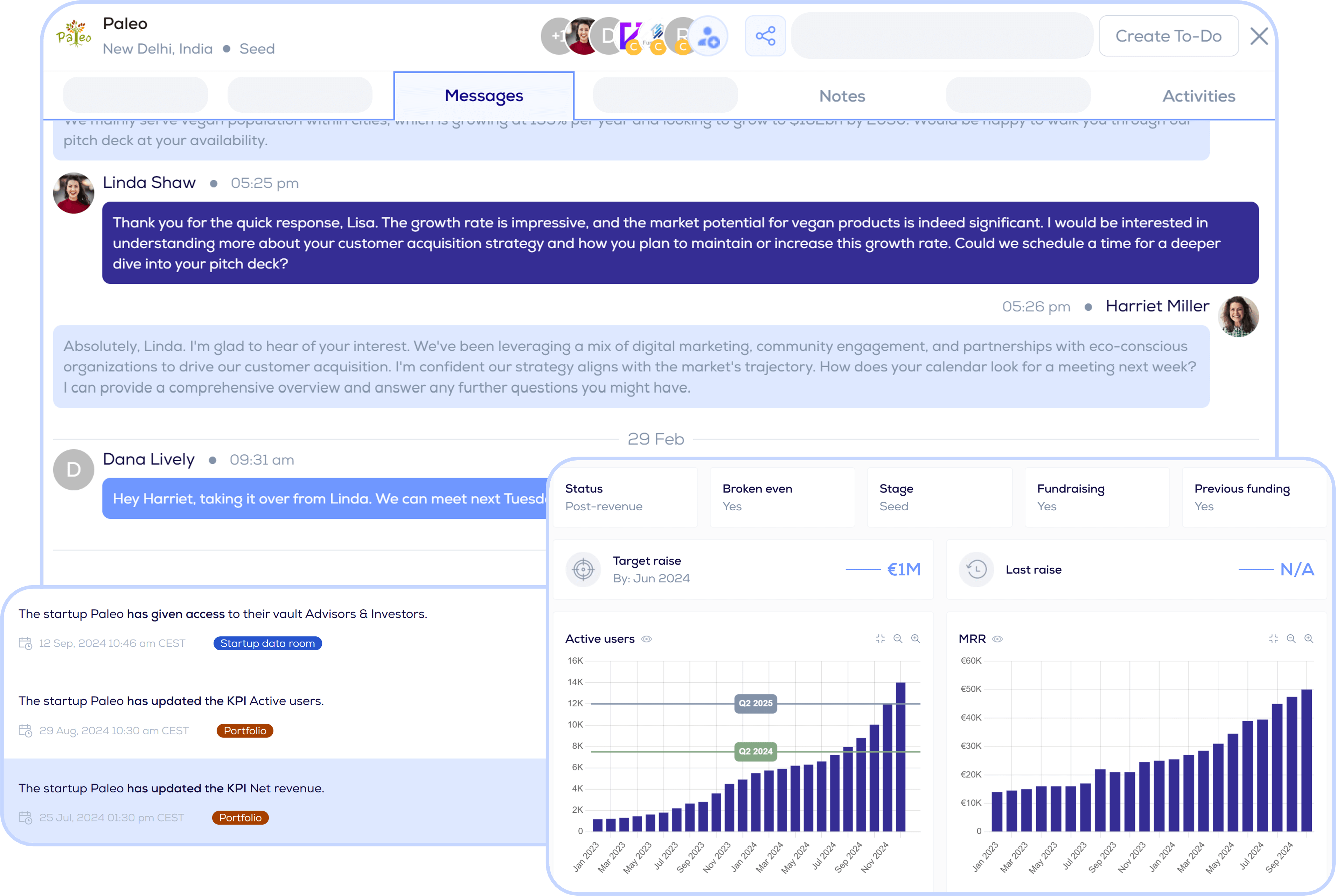

Weekly Intelligence Brief

A recurring, human-curated analysis of your VDR engagement analytics, delivered with prioritized recommendations for your team's next actions.

FAQ

Frequently asked questions

Get your answers to the most common questions that investors have.

- Do you introduce investors?

-

Execution is under your brand and approvals. We provide the intelligence and playbook to help your team execute a targeted outreach strategy. We do not solicit investors or act as a placement agent on your behalf.

- Who holds the money/records?

-

Never DueDash. We are a software and enablement service provider. Your designated fund administrator and legal counsel remain the system-of-record for all transactions and registers.

- Can we run outreach ourselves?

-

Yes. Our platform is designed for self-execution. These enablement services are an accelerator, installing best practices and configuring the platform to an institutional standard in a fraction of the time.

DueDash is not a broker-dealer, investment adviser, transfer agent, custodian, or placement agent and does not provide legal, tax, or investment advice. All document execution, KYC/KYB, cash movement, and registers are operated by the client’s appointed administrator or licensed partners. DueDash surfaces statuses and records an audit trail for coordination purposes only.