Scale your private equity operations

Track assets, benchmark performance, and manage portfolios efficiently with DueDash’s modular platform designed for private equity firms.

Users globally

Data rooms accessed

Deal flow managed

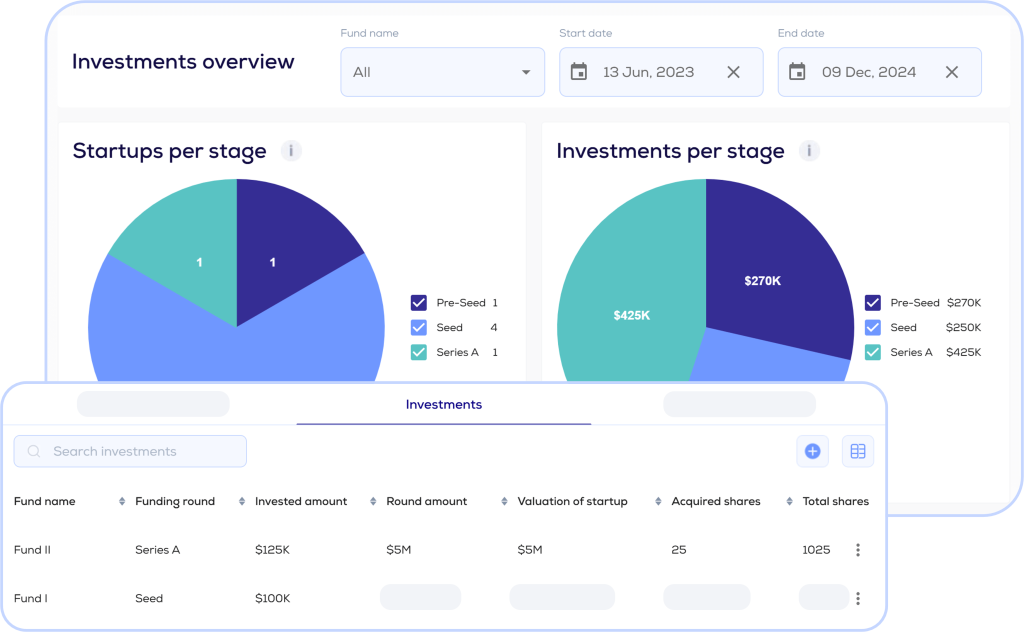

Comprehensive asset tracking

Centralize data and simplify oversight

Consolidate data from all investments into one platform. Define and track key metrics to monitor asset performance. Automate updates and access visual insights to identify growth opportunities across your portfolio.

Benchmarking and performance insights

Compare investments with self-defined KPIs

Benchmark portfolio performance against custom KPIs to analyze trends, correlations, and outliers. Optimize decisions with automatic reminders & dashboards, ensuring alignment with investment goals.

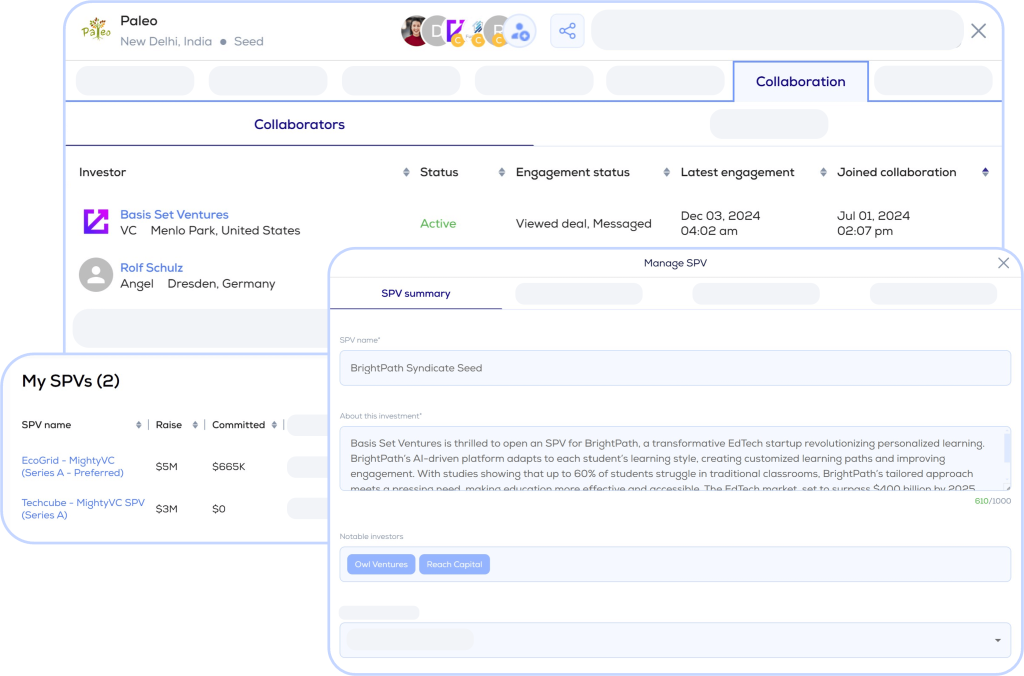

Scalable private equity tools

Efficiently manage complex fund structures

Simplify SPV creation, compliance workflows, and co-investor management with modular private equity tools. Streamline the management of multiple asset classes and stages, ensuring efficiency and transparency across funds.

Book your PE demo for tailored asset insights

Learn how DueDash enables PE firms to streamline operations, benchmark investments, and manage funds with scalable and efficient private equity crm solutions.

Beyond technology

Our expertise extends to services that enhance operational efficiency for PE firms.

Get in touch

Ready to elevate your private equity operations?

Submit a request to explore how DueDash can help you scale with confidence.